AMERICA’S CHINA TRADE WAR DILEMMA

America’s China trade war dilemma will end when China finally wins her independence then legitimate foreign trading interests will enjoy more opportunities than ever before. The power of production and consumption of 450,000,000 people is not a matter that can remain the exclusive interest of the Chinese, but one that must engage the many nations. Our millions of people, once really emancipated, with their great latent productive possibilities freed for creative activity in every field, can help improve the economy as well as raise the cultural level of the whole world. Mao Zedong[1], July 13, 1936.

AMERICA’S CHINA TRADE WAR DILEMMA: EMBARGO

Modern China has spent forty of its seventy years under American and Western embargoes, so the current round is nothing new. How likely is it to succeed?

In 1949 Mao inherited the poorest country on earth, devastated by a century of wars, occupation, disease, and famine. The US immediately broke all contacts, withdrew its diplomats, ordered its citizens home, forbade trade and financial exchanges and penalized infractions severely (the American editor of China Daily News, Gene Moy, was imprisoned in Danbury, CT, for accepting a thirty-five dollar money from the Bank of China for a classified ad about remittances from overseas Chinese) and embargoed food, finance, technology, medical supplies and agricultural equipment and excluded China from the United Nations and all international bodies.

The result?

Mao doubled the population, grew the economy twice as fast as postwar America’s while increasing per capita income 63%. For perspective, during Germany’s economic takeoff, 1880-1914, growth was 33% per decade, Japan’s from 1874-1929 was 43 per cent, the Soviet Union’s between 1928-58 was 54 per cent, China’s between 1952-72 was 64 per cent.https://www.herecomeschina.com/ Save for limited Soviet aid in the 1950s (repaid in full and with interest by 1966) industrialization proceeded without foreign loans or investments and under punitive embargoes. Mao left China with powerful factories, nuclear weapons, satellites and an economy burdened neither by foreign debt nor internal inflation.

AMERICA’S CHINA TRADE WAR DILEMMA POLICY

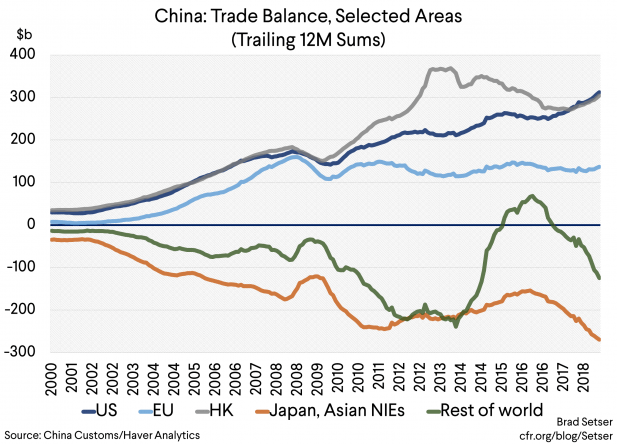

WTO rules confront America with a policy dilemma. The per capita income disparity with China drained jobs to China but rising Chinese per capita income, which will slow the job drain, is raising China’s aggregate national wealth and threatening America’s economic world dominance, as this chart suggests:

NEGOTIATING AMERICA’S CHINA TRADE WAR POLICY DILEMMA

Negotiating skill is widely admired in China and one of its great practitioners, Xi Zhongxun–a civil war general at seventeen–would ride into the hills alone and emerge with entire rebel armies trotting happily behind him. Mao compared him to a famous negotiator in Dream of The Red Mansions and Xi coached his son, Jinping, until his death in 2002.

Jinping is now offering Donald Trump a tactical win in exchange for a strategic victory: China will reshuffle its trade preferences if America publicly recognizes China as a peer. Ray Dalio’s BFF, Vice Premier Liu He, spelled out Jinping’s terms:

- Lift all punitive, non-WTO tariffs, embargoes, and bans before the agreement is signed.

- All conditions in the agreement must apply equally to both parties.

- Xi’s original 2018 offer may be embellished but not substantively changed.

- China has twenty years to implement the terms of the agreement.

If he fails to reach an agreement, Trump dims his reelection hopes but, if he agrees, he recognizes China as a peer and damages American credibility with allies and adversaries alike. Recall that US officials threatened allies that dealing with Huawei endangered their security ties. Governments that capitulated, like Canada’s, Australia’s and New Zealand’s – whose exports depend on China – will look like weaklings and fools. As Omar Bradley might have said, this may be the wrong trade war in the wrong place at the wrong time with the wrong enemy.

AMERICA’S CHINA TRADE WAR DILEMMA: BITCHING AND MOANING

Though Trump charges that China infringes American IP rights, China’s payments of licensing fees and royalties for the use of foreign technology have reached $30 billion annually, nearly a four-fold increase over the last decade. Court filings show that China is a minor IP infringer and, domestically, China’s Progress on Intellectual Property Rights has been swift and substantial. Complaints about ‘forced’ contributions of IP to joint ventures are daft: companies sign them voluntarily to make profits and open new markets.

AMERICA’S CHINA TRADE WAR DILEMMA: SUBSIDIES

The US Government spends $4.5 billion annually to subsidize a cotton crop so that it can be sold for $6 billion (it would otherwise be priced at $12 billion), allowing US growers to profitably export three quarters of their output and to control 40% of the world cotton trade. What the US loses in textile manufacturing it regains in subsidized cotton exports, high returns on investment from its overseas textile mills, and low-cost cotton goods for its consumers. The subsidy ruins the economies of the world’s poorest nations. All rich countries do this. There are dozens of such examples.

A SENSE OF PROPORTION ABOUT AMERICA’S CHINA TRADE WAR DILEMMA

The simple truth today is that your [US] economy is built on the global economy. TRADE WAR AMERICA’S POLICY DILEMMA And it’s built on the support, the gratuitous support, of a lot of countries.

So why don’t you come over and … I won’t say kowtow [with a laugh], but at least, be nice to the countries that lend you money. Talk to the Chinese! Talk to the Middle Easterners! And pull your troops back! Take the troops back, demobilize many of the troops, so that you can save some money rather than spending $2 billion every day on them. And then tell your people that you need to save, and come out with a long-term, sustainable financial policy.

Current Trade War Conditions

The current conditions can’t go on. It is time for the new government to really tell people: “Look, this is wartime, this is about the survival of our nation. It’s not about our supremacy in the world. Let’s not even talk about that anymore. Let’s get down to the very basics of our livelihood.” So, i have great admiration of American people. Creative, hard-working, trusting, and freedom-loving.

But you have to have someone to tell you the truth. And then, start realizing it. And if you do it, just like what you did in the Second World War, then you’ll be great again! If that happens, then of course—American power would still be there for at least as long as I am living. But many people are betting on the other side. – Gao Xiqing, President, China Investment Corporation.

Neither China nor the US is overly trade-dependent. Trade accounts for 26% of America’s GDP and 37% of China’s–compared to 56% of Canada’s and 86% of Europe’s. Chinese imports are 18.7% of GDP and US imports are 14.6% of GDP.

Over the past ten years China has steadily reduced her overall reliance on trade, particularly with the USA. China’s net exports–exports minus imports–are two percent of GDP. Since 2007 China’s global current-account surplus has fallen from 10% of GDP to 1.4% but America’s deficit has remained unchanged.

The average Chinese tariff on US-made products is 20.7%, compared to 6.7% on competing products from WTO-compliant countries (151 countries have filed WTO complaints against the US, 85 have filed against the EU, 43 have filed against China). Exports to the US fell 4.8% in 1H 2019 while exports to the EU rose 14.2%.

Trading Partner

China is America’s biggest trading partner while America is China’s third biggest trading partner after the EU and ASEAN. ASEAN replaced the US as China’s second-largest export market last year and the signing of the Regional Comprehensive Economic Partnership[2] later this year will boost area trade significantly.

Though it is due to come into force next year, China has already granted all the benefits of the EU-China Bilateral Investment Agreement to European investors without requiring reciprocity. Belt and Road trade is rising 17.2% annually, trans-Eurasian trains now depart hourly and fiber-optic cables and pipelines are rapidly uniting Mackinder’s World Island, the Eurasian landmass.

China is lowering tariffs and opening domestic markets to attract multinationals and foreign products in order to force domestic companies to innovate, which is why it is now the largest recipient of foreign direct investment, FDI, in the world.

In Bloomberg’s worst-case embargo scenario, China’s US trade would fall by $126 billion, 0.8% of GDP, and US trade would fall by 0.5% OF GDP, leaving the global pecking order unchanged. However, since Xi warned his country in 2016 to prepare for this possibility–and since the Chinese always heed their leaders’ words–the impact on China may be less severe than Bloomberg anticipates TRADE WAR AMERICA’S POLICY DILEMMA.

TRADE WAR STRAWS IN THE WIND

- Huawei’s YOY handset shipments rose 50% in H1 2019 while Apple’s fell 30%.

- Huawei has 65% of the world’s 5G equipment contracts. All four of the UK’s wireless providers (EE, O2, Three, Vodafone), for example, are installing Huawei 5G networks. Monaco’s is fully operational.

- China Mobile, with one billion customers, awarded 34% of its 5G equipment contract to Ericsson and Nokia and 5% to state-owned ZTE.

- There are thousands of US Corporations in China and two-thirds of the largest exporters in China are foreign-owned.

- Boeing sells more aeroplanes to China than anywhere else and Walmart produces more goods from than any other company in the world.

- US companies in China sell $600 billion annually into China’s domestic market–$100 billion more than

-

China exports to the US–and generate net profits of $50+ billion annually.

- Tesla, Boeing, BMW of America, Exxon Mobil and Wal-Mart have announced new investments and factories in China since the trade war began and Japanese, South Korean, and European companies are expanding their footprints there because Chinese sales are growing six per cent annually.

- Of the factories operated by Apple’s top suppliers, 357 are in China and 63 are in America. Apple is shifting Mac Pro manufacturing from the US to China.

- By shortening its negative list for foreign investment from 63 items to 48 last month, China widened access to its primary, secondary and tertiary sectors and detailed 22 opening-up measures in finance, transportation, professional services, infrastructure, energy, resources and agriculture.

-

China’s domestic consumer market, at $7 trillion, passed the US’s $6.94 trillion last year.

- Chinese cross-border e-commerce consumers spent $100 billion on goods from abroad in 2017 and $128 billion in 2018.

- Actually used foreign capital totalled 478.33 billion yuan for a YoY rise of 7.2%, while in June alone the figure was 109.27 billion yuan for YoY growth of 8.5%.

- Foreign investment in China’s hi-tech sector accelerated So, with YoY growth in actually used foreign capital in the sector of 44.3%, accounting for a 28.8% share of the total.

- They, actually used foreign capital for the hi-tech manufacturing sector was 50.28 billion yuan, for YoY growth of 13.4%. While the figure for the hi-tech services sector was 87.56 billion yuan, for YoY growth of 71.1%.

- Actually used foreign capital for information services, R&D and design services and tech conversion services saw YoY gains of 68.1%, 77.7% and 62.7% respectively.

- Actually used foreign capital for western China totalled 34.96 billion yuan, for YoY growth of 21.2%, while free trade pilot zones in China saw a YoY increase of 20.1%.

- The in-bound foreign investment sums of the EU, ASEAN and Belt and Road nations posted YoY gains of 22.5%, 7.2% and 8.5% respectively.

FUN FACTS

- The US Air Force has awarded China’s DJI a contract for security UAVs.

- The Holy See has urged Chinese priests to register with Beijing and it is distinctly possible that the next Pope will be a Chinese Communist. I kid you not.

THE CLASH OF CIVILIZATIONS

Twenty years ago Samuel Huntington[3] observed, “Civilizations grow because they have an instrument of expansion, a military, religious, political, or economic organization that accumulates surplus and invests it in product innovations and they decline when trade WAR AMERICA’S POLICY DILEMMA stop the application of surplus to new ways of doing things. So, in modern terms, we say that the rate of investment decreases. This happens because the social groups controlling the surplus have a vested interest in using it for non-productive but ego-satisfying purposes which distribute the surpluses to consumption but do not provide more effective methods of production.”

As the chart below makes clear, the social groups controlling America’s surplus used it for non-productive, ego-satisfying purposes and distributed the surpluses to consumption but did not provide more effective methods of production:

We’ve cut R&D investment, shuttered our great corporate labs and fallen from first to thirty-first in world education rankings since 1974, while China has done the opposite. In Crazy Rich Asians a father urges his kids to finish their dinner, “Think of all the starving children in America”. By 2021 every Chinese will have a home, a job, plenty of food, education, safe streets, health and old-age care and there will be more suicides and more homeless, poor, hungry children and imprisoned people in America than in China. So, in absolute numbers. Think of the impact on our ‘allies.’

America’s trade war dilemma TIMELINE

August 2012:

Huawei’s CEO, “It is out of strategic concern that we have decided to develop our own device OS. If they forbid us from using Android and Windows Phone 8 one day, will we be caught empty-handed and have nothing to do? When they refuse to sell things to us, our products can also be used as backups even though the quality is not as good as theirs.”

August 2015:

The US blocks Intel’s Xeon and Xeon Phi export license fearing their use in Chinese supercomputers.

March 2016

China unveils the world’s fastest supercomputer, built entirely with domestic chips and IP.

April 2016:

President Xi: “Core technology controlled by others is our greatest hidden danger.”

September 2017:

Huawei unveils its Kirin 970 chipset with built-in AI, dedicated neural processing, 5.5 billion transistors/sq. cm., 25x performance and 50x efficiency of ARM’s quad-core Cortex-A73 CPU cluster, TRADE WAR AMERICA’S POLICY DILEMMA drastically reducing cost, power consumption, weight and tower size.

December 2017:

China publishes 641 AI patents compared to America’s 13o, according to the US National Science Foundation, (NSF).

January 3, 2018:

“There are only two truly vertically integrated mobile OEMs who have full control over their silicon: Apple and Huawei. Huawei is more integrated due to in-house modem development. Huawei has been the one company to be competitive with the current leader, Qualcomm”.

January 18, 2018:

China becomes the world’s largest producer of scientific research papers, 20% of total global output. (NSF)

February 14, 2018:

US Congress labels Huawei “an arm of the Chinese government,” bans it from bidding on US government contracts.

March 5, 2018:

China’s IC industry grows 21% annually, from $13.6 billion in 2013 to $30 billion.

March 11, 2018:

Huawei owns 23% of 5G technology IP, more than any company.

March 22, 2018:

China’s IP office received the most patent applications in 2017, a record total of 1.38 million, followed by the USPTO (607,000). Japan (318,000), South Korea (205,000), and the European Patent Office (167,000).

Mar 27, 2018:

Trump, Treasury block China investment in US tech firms, stocks, preventing Chinese investment in emerging technologies.

April 16, 2018:

US prohibits transactions with ZTE Corporation for seven years on the grounds that ZTE violated its 2017 Iran settlement agreement.

On April 26, 2018:

Qualcomm begins layoffs.

April 26, 2018:

Huawei Criminally Investigated For Iran sales.

May 1, 2018:

Chinese partners take over ARM’s operations in China and a permanent license to use ARM’s IP. ARM’s chip blueprint is used in ninety percent of mobile devices and Apple, Samsung, Huawei, Qualcomm. So, broadcom and MediaTek license its technology to develop chipsets for smartphone, tablets, wearables and connected devices.

July 8, 2018:

Average senior managerial tech salaries reach $216,000 in China, competitive with Silicon Valley.

July 12, 2018:

More than three hundred senior Taiwanese engineers move to mainland chip makers, joining a thousand who have already relocated for 4x higher salaries.

July 9, 2018:

Chinese chipmaker Hygon manufactures Zen-based x86 CPUs under a $293 million licensing agreement with AMD.

September 3, 2018:

Huawei unveils Kirin 980 CPU, the world’s first commercial 7nm system-on-chip (SoC), with 40 percent lower power consumption than 10nm systems, 20% more bandwidth and 22% lower latency than Qualcomm’s Snapdragon 845. Its L5 frequency GPS receiver delivers 10cm. positioning.

September 5, 2018:

China’s front-end fabs accounted for 16 per cent of the world’s semiconductor capacity and will capture 20 per cent by 2020.

September 21, 2018:

China has twelve of the world’s top fifty IC design houses and 21% of global IC design revenues.

October 2, 2018:

Chinese research makes up 18.6% of global STEM peer-reviewed papers, ahead of America’s 18%.

October 14, 2018:

Huawei ships 7 nm Ascend 910 chipset for data centres, twice as powerful as Nvidia’s v100 and the first AI IP chip series to natively provide optimal TeraOPS per watt in all scenarios.

October 8, 2018:

Taiwan’s Foxconn moves its major semiconductor maker and five IC design companies to Jinan, China.

October 22, 2018:

China becomes the world leader in venture capital, ahead of the US and almost twice the rest of the world’s $53.4 billion. Crunchbase claims the world’s entrepreneurial ecosystem is driven by China.

Oct 25 2018:

Nokia confirms ‘thousands’ of job losses over the next two years after third-quarter profits drop.

Oct. 31, 2018:

Chinese airline reservations to the US dropped 42 per cent for the first week of October and 102,000 fewer Chinese received business, leisure and educational visas from May through September, a 13 per cent drop YOY.

November 2, 2018.

“The most valuable speech recognition companies, machine translation companies, drone companies, computer vision companies and facial-recognition companies are all Chinese.”– Kaifu Lee.

November 3, 2018:

Huawei announces it will ship 5G handsets in 2019. Apple announces it will not.

November 17, 2018:

Kai-Fu Lee says his investment firm may scale back in the U.S. and try to lure US talent to China instead of investing in America.

Dec 6, 2018:

December 7, 2018:

5G requires more base stations than existing networks. China has ten times more than the US: 5.3 sites per ten square miles vs. 0.4 in the US TRADE WAR AMERICA’S POLICY DILEMMA.

December 10, 2018:

Governments and secret services in the non-Western world begin equipping themselves exclusively with Huawei to protect the confidentiality of their communications.

December 21, 2018:

Foxconn plans $9bn China chip project amid the trade war.

December 22, 2018:

China’s Fourth Paradigm sells a second-generation AI product–a suite of AI software tools with a customised chip to process its algorithms. It allows the world’s biggest banks to run complex fraud detection algorithms and other analyses without trained AI engineers.

December 24, 2018

Chinese imports posted a 14.6% rise for the first eleven months of 2018 to exceed US$2 trillion, a record high, making China the most powerful trading nation both by volume and dollar value.

January 1, 2019:

In 2018 China, Apple’s third-biggest market accounted for sales of $52 billion. Qualcomm’s $15 billion represent 65 per cent of its total sales. Intel’s are 24 per cent, Micron Technology’s are 51 per cent, and Texas Instruments are 44 per cent.

January 7, 2019

Huawei Unveils the highest-performing ARM-based 7nm CPU, the Kunpeng 920, that boosts the development of computing in big data, distributed storage, and ARM-native application scenarios by 20%.

February 21, 2019

Huawei gear tests out as 30% more energy-efficient than competitors’ and cuts connectivity cost-per-bit for by 80-90% compared to 4G. Although, its 5G base station is 40% of the size and weight of competing models and can be installed by two people in hours.

THE PAST AS PRELUDE TO AMERICA’S CHINA TRADE WAR DILEMMA

Midway in the sixteenth century, China became the great repository of the early modern world’s newly discovered wealth in silver. Long a participant in international maritime trade. SO, TRADE WAR AMERICA’S POLICY DILEMMA China experienced the consequences of the greatly enlarged patterns in world trade. In that commerce, China was essentially a seller of high-quality craft manufactures. Other countries could not compete either in quality or price. So, the colonies of the New World and the entire Mediterranean sphere of trade. From Portugal and Spain to the Ottoman Empire. So, began to complain that the influx of Chinese goods undermined their economies. F.W. Mote, Imperial China 900-1800.

- Red Star Over China, by Edgar Snow. ↑

- A free trade agreement between Brunei, Cambodia, Indonesia, Laos, Malaysia, Myanmar. The Philippines, Singapore, Thailand, Vietnam, China, Japan, South Korea, India, Australia and New Zealand. According to PwC, the RCEP’s GDP, PPP, will be $250 trillion by 2050, half of global GDP. ↑

- Clash of Civilizations and the Remaking of the World Order, Samuel Huntington ↑